Last one: Outro!

The following article was written in the week of the 19th-23rd of September 2022. Due to Substack’s publishing limitations, the article is broken down into 6 independent parts.

The events that unfolded in the week after (the 24th-30th of September 2022) made some chart and price data presented here, partially outdated.

The core narrative outlined in the article did not change.

… or a conclusion

Well, I will leave that to you, dear reader. I have presented fresh data and facts, along with my thoughts and comments on the matter discussed.

A tiny addendum

The main task of any central bank is price stability. We have the worst inflation in the last four decades, and the central banks have reacted too late and too poorly to tackle it. Now, it is snowballing.

The rate hikes by the U.S. central bank, the FED, have a positive effect on the U.S. dollar’s strength. Any country with debt obligations denominated in U.S. dollars has it now harder to service that debt. It also makes such a country’s own inflation troubles even more difficult. This is especially the case with emerging markets.

The US Dollar Currency Index (DXY) is currently trading at a 20-year high, whilst Euro depreciates still and at the time of writing is worth less than one USD, back to its price level from 2002… losing over 19% in just one year. A country’s currency depreciation is detrimental to its socioeconomic wellbeing. And what about currency unions?

Big questions, tough to answer definitively.

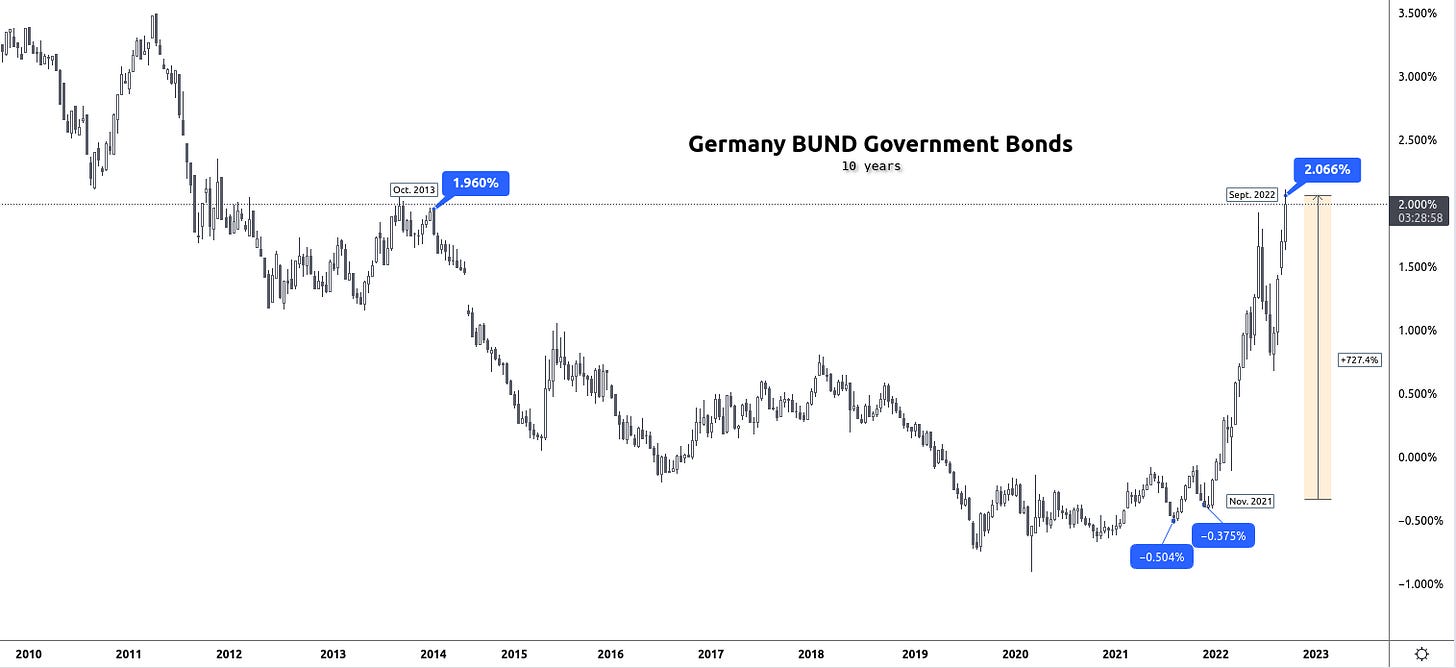

While you perhaps ponder over the answer, take a look at a few charts from the 23rd of September 2022, around market close.

Congrats! You have made it this far!

Thank you for reading!

References:

http://controlc.com/0b7f19e4

Start over and read from the beginning: Part 1

Chips, oil, and gas - What’s cooking?

The following article was written in the week of the 19th-23rd of September 2022. Due to Substack’s publishing limitations, the article is broken down into 6 independent parts. The events that unfolded in the week after (the 24th-30th of September 2022) made some chart and price data presented here, partially outdated.