Part 2

The following article was written in the week of the 19th-23rd of September 2022. Due to Substack’s publishing limitations, the article is broken down into 6 independent parts.

The events that unfolded in the week after (the 24th-30th of September 2022) made some chart and price data presented here, partially outdated.

The core narrative outlined in the article did not change.

Part 2 - Did someone order gas?

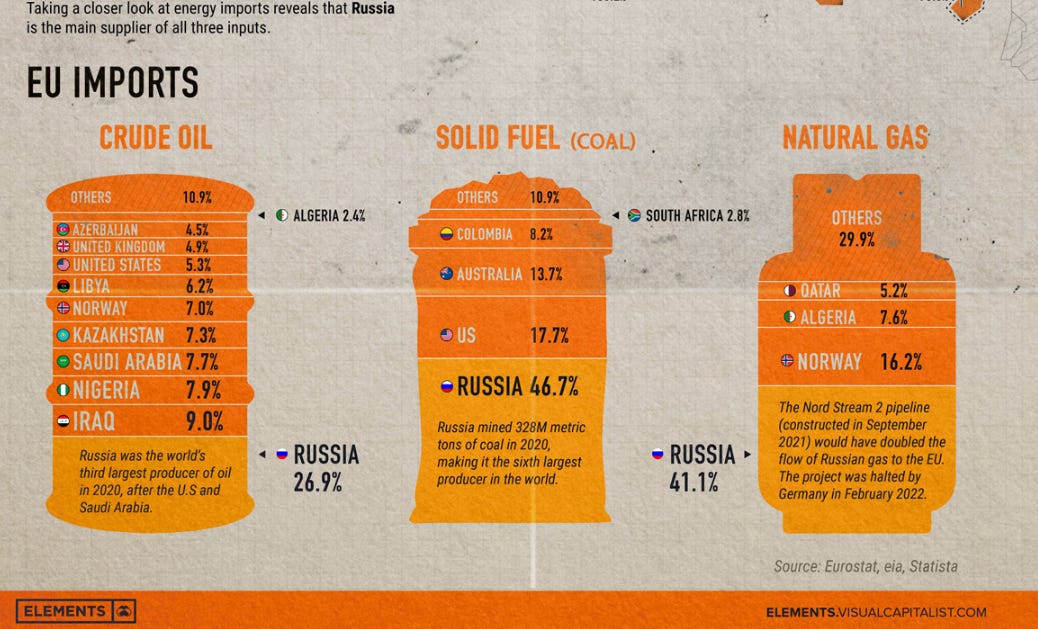

For decades, Russia has been a very reliant and cheap source of commodities for the EU and the world economy. Natural gas is one of those commodities. So is wheat, and so is uranium. Food and energy. The EU countries, especially Germany, use(d) Russia’s gas as a source of cheap energy, for both industrial (i.e., manufacturing) applications and households. Natural gas is the world's third-biggest energy source, after oil and coal. Germany is heavily reliant on Russia’s gas, and Germany’s industrial infrastructure is designed and built to work on this particular gas. Because gas is not the same as gas. There are differences in caloric value. There are no such issues with Norway’s gas, though.

Norway currently covers about 30% of Germany’s gas demand via two pipelines, Europipe I & II, and about 20% of the EU’s. At the time of writing (September-22), Norwegian gas production is at its peak and the said pipelines are at full capacity. However, Norway’s gas supplies are insufficient to cover Germany’s demand and substitute Russia’s gas. Despite that, Norway is massively profiting from the war situation, exporting gas and oil to its neighbours.

Norway’s state energy producer Equinor netted a profit of €6.6bn for the 2nd Quarter 2022, an increase exceeding 300% compared to the 2nd Quarter 2021 with €1.9bn. The Netherlands is importing gasoil from China, leading to China’s record-high cargo shipments to Europe in August-22, making over 31% of its total exports. This surge in shipments is noticeable: in the last 13 months, there were no note-worthy exports. Both parties are taking advantage of the arbitrage opportunities due to Europe’s effort to switch from gas to oil. It is a trend expected to reach about half of the global share of gas-to-oil switching in the 1st Quarter 2023.

Putting things in context, let us analyse some numbers, to get a grasp on the scale of the negative effects of the EU’s sanctions on the EU’s own economy.

Even with this data from 2020, it is apparent, that Russia has been the EU’s No.1 energy supplier.

What about Germany?

As the EU economy’s engine, Germany has a 55% share of its consumed gas covered by imported Russian natural gas. It is heavily used for industrial purposes, with over 31% of total imported gas in 2020. That is more than a fair share of dependency on the, also by Germany’s own hand, sanctioned Russian supplier. Holding true to such facts, in March 2022, the Chancellor of Germany, Olaf Scholz, said:

"We will end this dependence [on Russian oil, coal and gas] as quickly as we can, but to do that from one day to the next would mean plunging our country and all of Europe into a recession…”. He further emphasised that "hundreds of thousands of jobs would be at risk, entire industries would be on the brink."

"The truth is that the sanctions that have already been decided also hit many [EU] citizens hard, and not just at the gas pump". Scholz also stated that [the sanctions] "must not hit the European countries harder than the Russian leadership", which can be interpreted as an unrealistic demand or even as wishful thinking, given the depth of the interrelationship between the EU’s energy demand and Russian supplies.

Germany’s economic output of $2 trillion of value added depended on $20 billion of Russian natural gas input. This represents an enormous leverage of operating costs. In other words: buying apples worth $20 to make apple pies that sell for $2000. And then suddenly apples become unavailable, or only in insufficient quantities and at exorbitant prices, many times higher than the average prices of the last 10 years.

Additionally, Liquefied Natural Gas (LNG) as an alternative was never much of an interesting option due to its generally two to three times higher prices than Russian natural gas via pipelines. The LNG infrastructure is almost non-existent for it to hold up as a viable alternative and serve Germany’s needs.

Fast forward to September 2022

Producer Price Index (PPI) in Germany increased by 45.8% compared to August 2021, which is at the highest level since 1949 (!). The PPI measures the price changes received by producers for their economic output. In 2020, PPI was negative. This was reported by Germany’s Federal Statistical Office, also stating that the price rose by 7.9% when compared to July 2022. The forecasts by analysts were implying a 37.1% year-over-year (YOY) and a 1.6% month-over-month (MOM) increase. The Aug-21 vs. Aug-22 realised price increase was over 23% higher than expected, and July-22 vs. Aug-22 was five times higher.

The data for energy prices shows an increase of 139% for the 12-month period of Aug-22 vs. Aug-21, and a 20.4% increase in Aug-22 over July-22. Producer prices for electricity are up 174.9% year-over-year and 26.4% month-over-month. When companies have increased costs to produce goods, the costs are passed onto the end consumer. But private households already received increased prices for their own energy consumption (electricity and gas) - the costs many can’t meet with their current income.

The research from September-22 by the Landesbank Baden-Württemberg expects that private households’ energy costs will easily double in 2022 compared to 2021. Ralph Solveen, an economist at Germany’s Commerzbank, said: "While declining momentum in intermediate goods prices gives reason to believe that consumer price inflation will peak in the coming months, the recent surge in energy prices shows that there is considerable potential for uncertainty here". He added that consumer price inflation is likely to reach new record levels in the months ahead. In other words: Buckle up!

What does this mean in plain English?

It means that Germany’s economy, as the EU’s largest economy, is heading at full speed into a serious recession, with consumer price inflation very likely soaring further up into the two-digits area. Germany’s inflation is already at 7.9%; the Eurozone’s is at 9.1%, and the European Union is at 10.1%. This translates to decreased production, company closures, scarcity of goods, loss of jobs, diminishing or decreasing income and spending, credit contraction, defaults on loans and mortgages (both corporate and private), rationing of commodities (especially gas) …

… while the prices stay high and keep on rising.

-- continue reading Part 3 here

Chips, oil, and gas - What’s cooking?

Part 3

The following article was written in the week of the 19th-23rd of September 2022. Due to Substack’s publishing limitations, the article is broken down into 6 independent parts. The events that unfolded in the week after (the 24th-30th of September 2022) made some chart and price data presented here, partially outdated.

or

Start over and read from the beginning: Part 1

Chips, oil, and gas - What’s cooking?

The following article was written in the week of the 19th-23rd of September 2022. Due to Substack’s publishing limitations, the article is broken down into 6 independent parts. The events that unfolded in the week after (the 24th-30th of September 2022) made some chart and price data presented here, partially outdated.